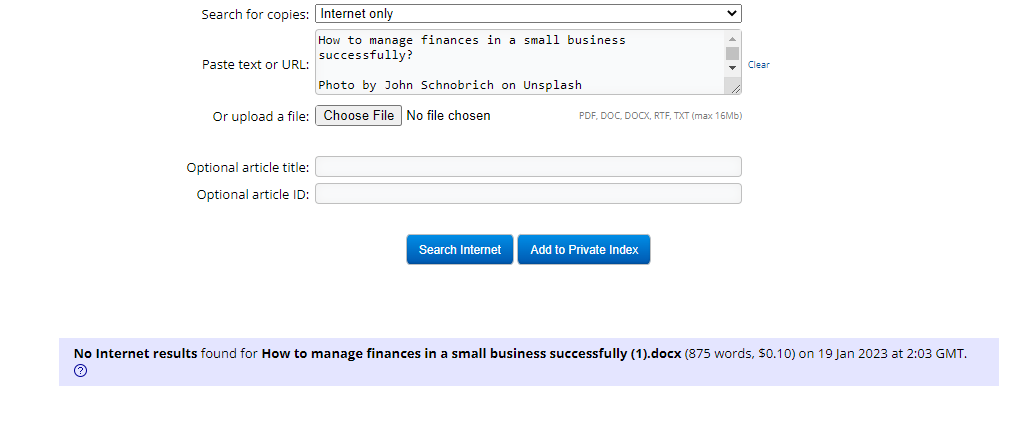

Photo by John Schnobrich on Unsplash

Small businesses do not have a large pool of funds and still contribute significantly to the economy. As per the Small Business Administration, there are over 32 million small businesses in the US. They categorize any business with less than 500 employees as a small business.

These businesses are the core of the economy, as they collectively provide the most employment. Still, every year, many small businesses fail and shut down because of financial mismanagement.

Managing finances is challenging and requires skills, along with knowledge, for a stable cash flow. As a small business owner, you must understand the basics, like simple accounting, creating and reading financial statements, negotiating better terms, and applying for loans.

If you are unable to control your finances, it can affect your business.

What are the primary challenges a small business can face?

Inconsistent cash flow

Small businesses do not have huge reserves, so the biggest problem is limited cash. As a result, you struggle to pay employees, creditors, and other expenses. It takes one bad month to pause the progression and disturb cash flow, which can take several months to stabilize.

Limited access to funding

The main reason for small business failure is that sales couldn’t keep up with the increasing expenses. For long-term success, you need different sources of funding. Once your cash reserves start depleting, the terms of lenders become harsher. Therefore, choosing the right funding option is crucial to success.

Repayment of debt

Generally, small businesses take debt to commence business, hoping to make it big. However, there are many uncertainties attached to a business, and unhealthy finances make small business owners’ lives miserable. It becomes so tough to repay debts that eventually, businesses file bankruptcy.

Not forecasting

You can run into unwanted scenarios that can adversely impact your finances. If you don’t have an emergency fund to get you through tough times or help you grow, then the chances of success are minimized. The odds are very likely for you to struggle because not handling cash properly can attract challenging times.

Compliance risks

You can also be directly affected by poor financial management. It is possible to suffer financial losses if you fail to file reports, especially when fines are imposed for missing deadlines.

Inadaptability

Mismanaged finances can cause the inability to capitalize on market opportunities. To stay competitive, your business needs resources that can capitalize on opportunities.

Limitation of resources

Financial constraints decrease your affordability to hire specialists and subject matter experts who can improve your processes and increase sales. Similarly, you cannot expand production. Instead, you only focus on bookkeeping and compliance.

How to improve the financial health of your small business?

Budgeting

The first and foremost step in managing small business finance is creating a budget and sticking to it. A budget gives you a clear position of your business and helps to differentiate necessary and unnecessary expenses. Once you have categorized expenses, you can control them.

It also allows you to fund unnecessary expenses through a loan from CreditNinja, which you can apply for online and take advantage of easy processing. Consequently, it opens up avenues for better utilization of existing resources and focuses on long-term investments.

Reinvest

It is a critical measure that you can take for your business. When a small business experiences a rise in profit, you must reinvest to keep up with the growth trajectory. Use the capital in rewarding employees, increasing production, new technology, and market research.

Finding new opportunities in good times saves you from challenging times. Bring in better personnel and improve customer experience, and as a result, you will have a better inflow of cash.

Keep track of your money

Monitoring spending is highly beneficial in small businesses. If you cannot keep track, you could end up overspending. It is normal for a small business owner to have multiple accounts, so make sure you are on top of the balances and know your spending limits.

Review your books monthly to protect your business from financial mishandling or fraud. It will also help you analyze your financial status and which areas need improvement.

Manage working capital

The balance of payments impacts the cash flow of any business. Having fewer receivable days than payable days means you need to change the billing strategy. To keep up with day-to-day operations, cash flow must be positive.

Cash tied up in unpaid invoices can lead to cash flow problems and can disturb working capital. To counter it, make your client pay you as soon as possible. Offer debtors cash discounts or other benefits of paying early, so you can have maximum cash for a long period.

Monitor ROI from your investments

Expenditures like hiring a new employee or renting out a machine, etc. do give you returns. Measuring ROIs allows you to make better decisions on if to further fund those expenses.

Adopt good financial habits

Establishing internal financial protocols will protect your company’s financial health, even if they are as simple as scheduling time for reviewing and updating financial records. It is important to stay on top of your finances to mitigate fraud or risk.