Market Scope and Overview

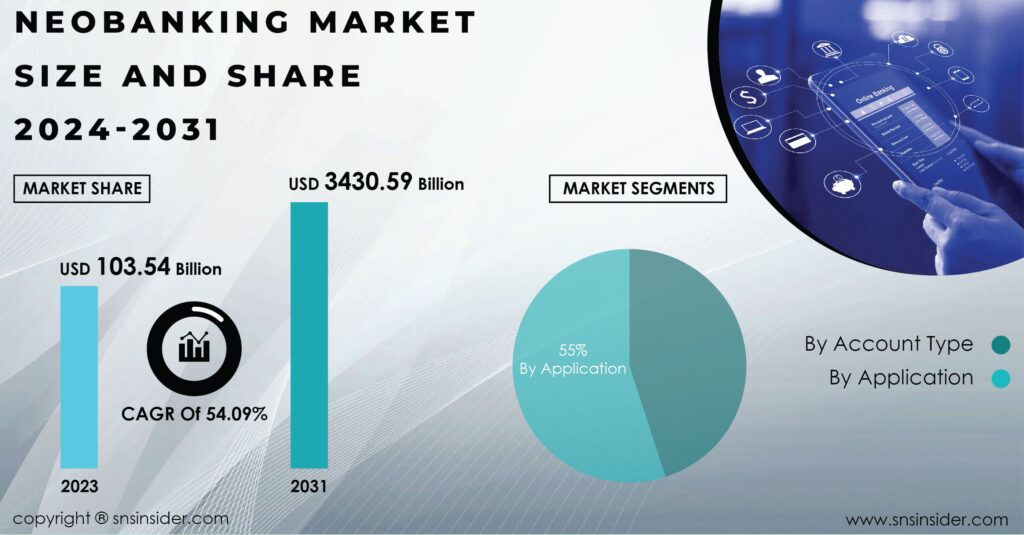

The global Neobanking Market is experiencing phenomenal growth, driven by the ever-increasing demand for convenient and tech-enabled financial services. A recent report by SNS Insider indicates the market size reached USD 103.54 billion in 2023 and is projected to soar to a staggering USD 3430.59 billion by 2031, reflecting a remarkable CAGR of 54.09% over the forecast period 2024-2031. This surge is attributed to the rising adoption of digital banking solutions, with consumers seeking user-friendly interfaces, innovative features, and seamless online experiences.

Get a Report Sample of Neobanking Market @ https://www.snsinsider.com/sample-request/1257

Major Key Players Studied in this Report are:

- Atom Bank

- BBVA

- BMTX

- Chime Financial

- Citigroup

- Dave

- Deutsche Bank AG

- Digibank (DBS Bank Ltd.)

- Equitable Bank

- HSBC Holdings

- Others

Growing Demand for Neobanking Solutions

The increasing digitalization of banking activities and the growing demand for mobile banking solutions are significant contributors. Neobanks, with their entirely online presence and reliance on fintech advancements, cater perfectly to this evolving consumer landscape. They offer a comprehensive suite of services traditionally provided by brick-and-mortar banks, including savings and checking accounts, credit cards, payment and money transfer services, loans, mortgages, investments, and even insurance products.

However, the report also acknowledges challenges hindering market growth. Security concerns, privacy issues, and the high implementation costs associated with establishing Neobanking platforms are potential roadblocks. Nevertheless, the report highlights a silver lining – rising investments in the fintech industry are expected to create lucrative opportunities for market expansion in the coming years.

Recent Developments

- In January 2024: Nu Mexico partnered with Felix Pago, enabling users to receive money transfers directly from the U.S. This simplifies the process of sending money across borders, highlighting Neobanking’s potential to revolutionize international financial transactions.

- In November 2023: N26, a leading neobank, expanded its product portfolio by launching an Instant Savings account in Germany. This account offers high-interest rates and eliminates hidden fees, further solidifying Neobanking’s appeal to cost-conscious consumers.

Market Segmentation Analysis

The Neobanking market can be segmented by account type and application.

- Business accounts dominated the market in 2023, accounting for over 66.1% of total revenue. This dominance can be attributed to the ease and efficiency neobanks provide for bulk payments to various businesses globally. Additionally, their streamlined platforms simplify receiving payments from suppliers and vendors, reducing administrative burdens.

- When it comes to application, the enterprise segment reigns supreme, holding over 52.3% of the market share in 2023. Neobanks cater to enterprises by offering valuable business services such as credit management, transaction management, and asset management. These services empower businesses to streamline their financial operations and optimize resource allocation.

The Russia-Ukraine War’s Impact

The ongoing war in Ukraine has had a multifaceted impact on the Neobanking sector. While the bank loan portfolio in Ukraine has significantly shrunk, the banking system has demonstrated remarkable resilience, maintaining access to cash and upholding healthy capital adequacy ratios. However, the war has also heightened cybersecurity concerns across the financial services industry, potentially encouraging neobanks to prioritize robust security investments. Overall, the war seems to have slowed Neobanking growth rather than causing a significant decline.

Economic Downturns

Economic slowdowns can pose challenges for neobanks, particularly those yet to achieve profitability. Securing funding becomes more difficult during these periods, potentially hindering expansion plans. Additionally, economic downturns often lead to changes in consumer spending patterns and fluctuations in interest rates, forcing neobanks to adapt their business models and risk management strategies. Reduced consumer spending can also dampen demand for non-core services like budgeting tools, impacting smaller neobanks specializing in such features.

However, economic slowdowns also present opportunities. Neobanks, with their emphasis on lower fees and convenient access to financial services, can become more attractive to cost-conscious consumers during challenging times. This opens doors for them to establish themselves as efficient alternatives to traditional banks. The slowdown might also spur innovation, incentivizing neobanks to develop even more efficient and cost-effective financial products, further enhancing their appeal to price-sensitive customers. While the global slowdown might pose initial challenges for new entrants, it can also be a turning point for neobanks that can demonstrate their value proposition and adapt to the changing economic landscape.

Ask for a Discount @ https://www.snsinsider.com/discount/1257

Key Regional Development

Europe currently holds the top spot (over 35%) due to its innovative tech culture and early adoption of new trends. Companies are also upping their game with better platforms and partnerships.

Asia Pacific is the rising star, predicted to be the fastest-growing region. This surge is fueled by a booming internet and mobile phone user base, along with the growing popularity of convenient digital banking options.

Key Takeaways

- The Neobanking market is poised for explosive growth, offering lucrative opportunities for players across the financial services ecosystem.

- Consumers are increasingly demanding convenient and tech-enabled financial services, driving the adoption of Neobanking

- Neobanks must continuously innovate and adapt their offerings to cater to evolving customer needs and stay ahead of the competition.

- Collaboration between neobanks, traditional financial institutions, and fintech companies will be crucial for unlocking the full potential of the market.

- As neobanks handle sensitive financial data, robust cybersecurity measures are essential to ensure customer trust and confidence.

Buy the Latest Version of this Report @ https://www.snsinsider.com/checkout/1257

Table of Contents- Major Key Points

- Introduction

- Research Methodology

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Challenges

- Impact Analysis

- COVID-19 Impact Analysis

- Impact of Ukraine- Russia war

- Impact of Ongoing Recession on Major Economies

- Value Chain Analysis

- Porter’s 5 Forces Model

- PEST Analysis

- Neo banking Market, by Account type

- Business Account

- Savings Account

- Neo banking Market, by Application

- Personal

- Enterprises

- Regional Analysis

- Introduction

- North America

- Europe

- Asia-Pacific

- The Middle East & Africa

- Latin America

- Company Profile

- Competitive Landscape

- Competitive Benchmarking

- Market Share Analysis

- Recent Developments

- USE Cases and Best Practices

- Conclusion

About Us

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Our staff is dedicated to giving our clients reliable information, and with expertise working in the majority of industrial sectors, we’re proud to be recognized as one of the world’s top market research firms. We can quickly design and implement pertinent research programs, including surveys and focus groups, and we have the resources and competence to deal with clients in practically any company sector.