Galectin Therapeutics Inc. (NASDAQ: GALT) shot up close to 32.4% on Monday on record breaking volume of 4.9 million shares in anticipation of a long awaited investor conference call at 4PM ET on September 29th. In after hours trading the stock continues to climb to $4.20. GALT has one of the worst track records when it comes to shareholder communications with only 9 press releases this year, so it’s easy to see why shareholders might be excited and speculating on news during the conference. GALT’s long term holders have pointed to outgoing CEO Harold Shlevin for the lack of communication while he focused on finishing the NASH phase 3 clinical trial design which took close to 2 years to complete.

There is much excitement surrounding the incoming CEO, Joel Lewis, who is one of the Chairman Uhlein’s top lieutenants within the multibillion dollar Uline Corporation worth an estimated $4 billion. Uline has a catalog order shipping supply business based in Wisconsin. Based on his previous job as investment advisor it’s reasonable to think that the new CEO Joel Lewis has the ear of the billionaire investor. With this shift in management, shareholders can be assured that the billionaire will very likely backstop the clinical trials with his own money.

Although money is a key issue in most biotechs, investors have seemed to figure out that it’s unlikely that Chairman Uhlein would dilute the company and tarnish his reputation. With the risk of dilution effectively off the table the stock price is readjusting higher. Minimizing future dilution is great, but the recent excitement is likely stemming from scientific journal articles that demonstrate that Galectin-3 inhibition is the key to solving the COVID-19 pandemic. Investors seem to be speculating on a COVID-19 treatment and 3 medical journal articles that seem to be in complete alignment that inhibiting galectins could be a treatment in both the viral stage of the disease and the hyperinflammatory stage of the disease. The journal articles position the galectin target as best in breed in the universe of therapeutics.

Management & Clinical Trial Combination Punch – Knockout Combination

Galectin Therapeutics indicated that they were going to talk about the NASH-RX trial and the new CEO, but investors who were paying attention to the one hour time allotment figured there was plenty of time to address other topics like COVID-19. The company historically operates in stealth mode and then stuns the investment community with their announcements. Like their greenlight to proceed with a phase 3 NASH trial in May 2018. The stock took off from $4.00 and in the course of a month reached $9.16 after Uhlein was appointed Chairman of the Board. This was the one two punch combination of a billionaire investor coupled by clinical trial green light. Now investors have the top Lieutenant likely followed by a new Clinical Trial Announcement. This could be a knockout combination.

Repurposing Cancer and Arthritis Drugs

Many drug development companies have been repurposing cancer drugs to treat COVID-19. It’s realistic to think that GALT is repurposing belapectin for COVID-19. The rationale for using cancer drugs traces its roots back to the reason we get cancer to begin with. Cancer is a product of our immune system malfunctioning. Our immune system is designed to clear cancer throughout our lifetime. It is also designed to clear viruses. Viral clearance and cancer clearance need a functioning immune system. In cancer, certain types of suppressor T-cells gain a foothold in the tumor and reprogram any killer T-cells that migrate into the tumor microenvironment. In COVID-19 or influenza the immune homeostasis is out of balance and skewed toward a hyperinflammatory response. This is called the cytokine storm where your body’s immune cells are attacking healthy cells due to a negative feedback loop driven by all the cytokines production in the lungs.

CANCER

The top repurposed COVID-19 therapeutics are leronlimab manufactured by CytoDyn Inc. (OTCMKTS: CYDY) and CD24Fc manufactured by privately held OncoImmune. Both of these drugs are monoclonal antibodies. Right now leronlimab is best in breed and slated for regulatory approval this year in either the US, UK, Philippines, or the European Union. Leronlimab was the first COVID-19 drug to meet their endpoint in a randomized double blind placebo controlled trial. In their mild to moderate clinical trial CD-10 they had a 60% reduction in SAE’s over placebo. The drug has been dosed in over 1000 patients in over 5 indications. The NEWS2 score identifies patients that risk progressing. In the CD-10 trial there was a statistically significant reduction in the score over placebo (p=.023). In addition their clinical symptom score was 90% in the active arm versus 71% in placebo at day 3. Based on their patient population this was only clinically significant and with a slightly larger trial would be statistically significant. CytoDyn also has an interim readout in the coming weeks for their Severe to Critical COVID-19 patients. They have virtually no exclusion criteria and are going after all cause 28 day mortality as their primary endpoint, the gold standard.

OncoImmune announced impressive interim results in their severe to critical COVID-19 trial. In terms of safety the risk of death or respiratory failure was reduced by 50% but Dr. Pan Zheng the Chief Medical Officer was quick to point out the composition of the study included use of drugs like dexamethasone, remdesivir, and corticosteroids. Their primary endpoint is time to improvement of their clinical status. Interim analysis showed that CD24Fc known as SACCOVID( ) had a 60% better chance of achieving clinical recovery over placebo (p=.005). The median recovery time was 6 days for SACCOVID(

) had a 60% better chance of achieving clinical recovery over placebo (p=.005). The median recovery time was 6 days for SACCOVID( ) versus 10 days in the placebo group. Keep in mind that remdesivir shortened the time of hospitalization from 15 days in the placebo group to 11 days. This statistically significant reduction (p=.059) led to an Emergency Use Authorization (EUA). Now the clinical trials are at 6 days for OncoImmune and less than 5 days for CytoDyn with an update in the coming weeks when topline data is released.

) versus 10 days in the placebo group. Keep in mind that remdesivir shortened the time of hospitalization from 15 days in the placebo group to 11 days. This statistically significant reduction (p=.059) led to an Emergency Use Authorization (EUA). Now the clinical trials are at 6 days for OncoImmune and less than 5 days for CytoDyn with an update in the coming weeks when topline data is released.

ARTHRITIS

Drug companies initially figured out that blocking certain cytokines might be beneficial. Arthritis drugs like Actemra manufactured by Roche Holdings (OTCMKTS: RBBHY) and Kevzara a joint venture manufactured by Regeneron Pharmaceuticals (NASDAQ: REGN) and Sanofi (NASDAQ: SNY) were used to target the IL-6 cytokine which is elevated in COVID-19. In August Roche announced that Actemra failed to meet its endpoint in COVID-19. Almost a month later in early September Kevzara announced that it failed as well. The only arthritis drug left in the space is Ampio Pharmaceuticals (NASDAQ: AMPE). It recently completed a phase 1 study with great results. In a proof of concept study IV use of the drug was extremely well tolerated with no adverse events and showed a greater improvement over the standard of care, which had one death and one hospitalization which represented 40% of the small cohort. In the active arm all severe patients were discharged in 5 days. The FDA quickly approved a phase 2 study for inhaled use of Ampion. What is different about Ampion is that it targets many inflammatory cytokines like (TNFα, IL-1β, IL-6, IL-12) and not just IL-6.

Journal Articles Linking Galectin Inhibitors to COVID-19

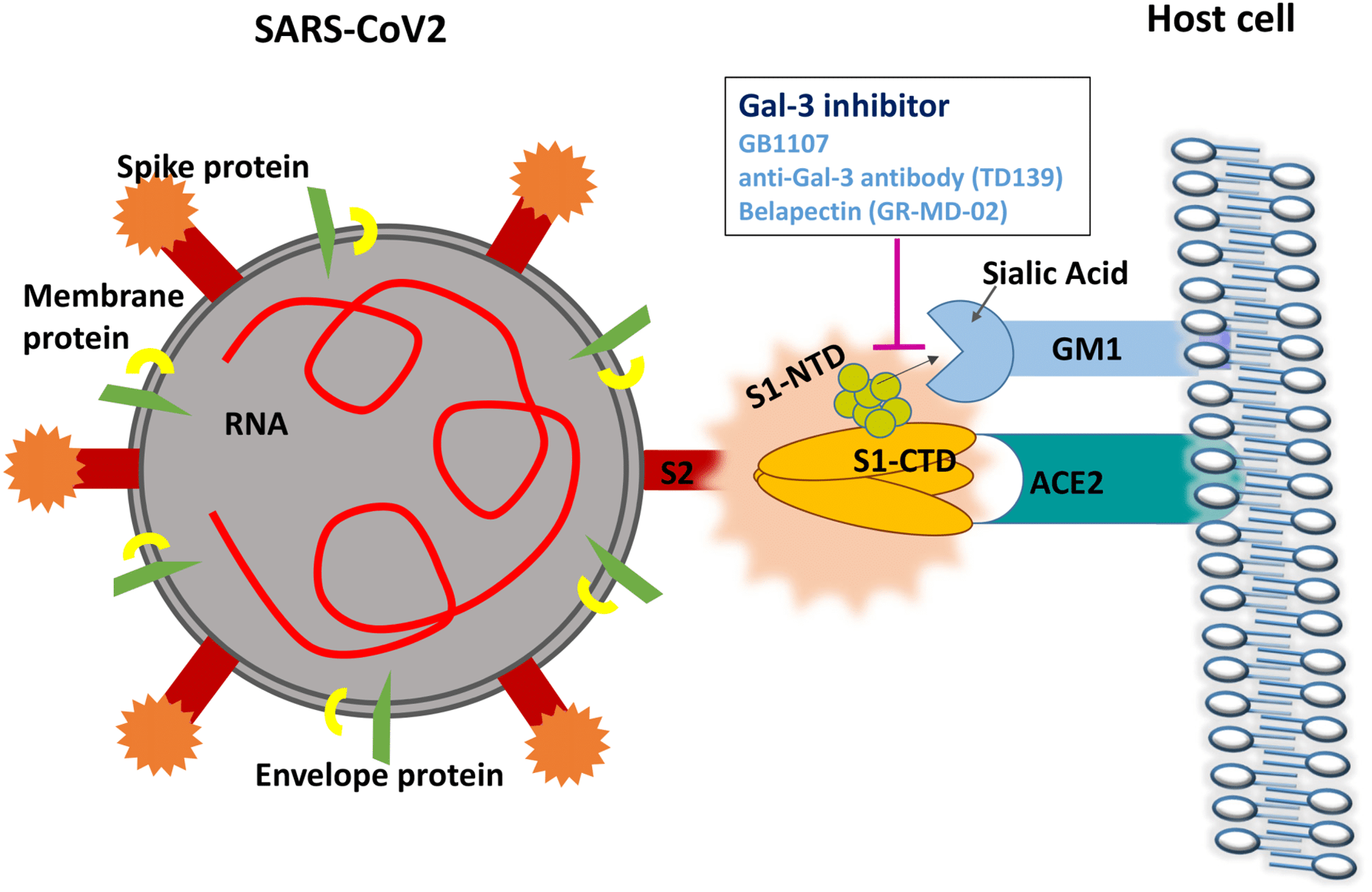

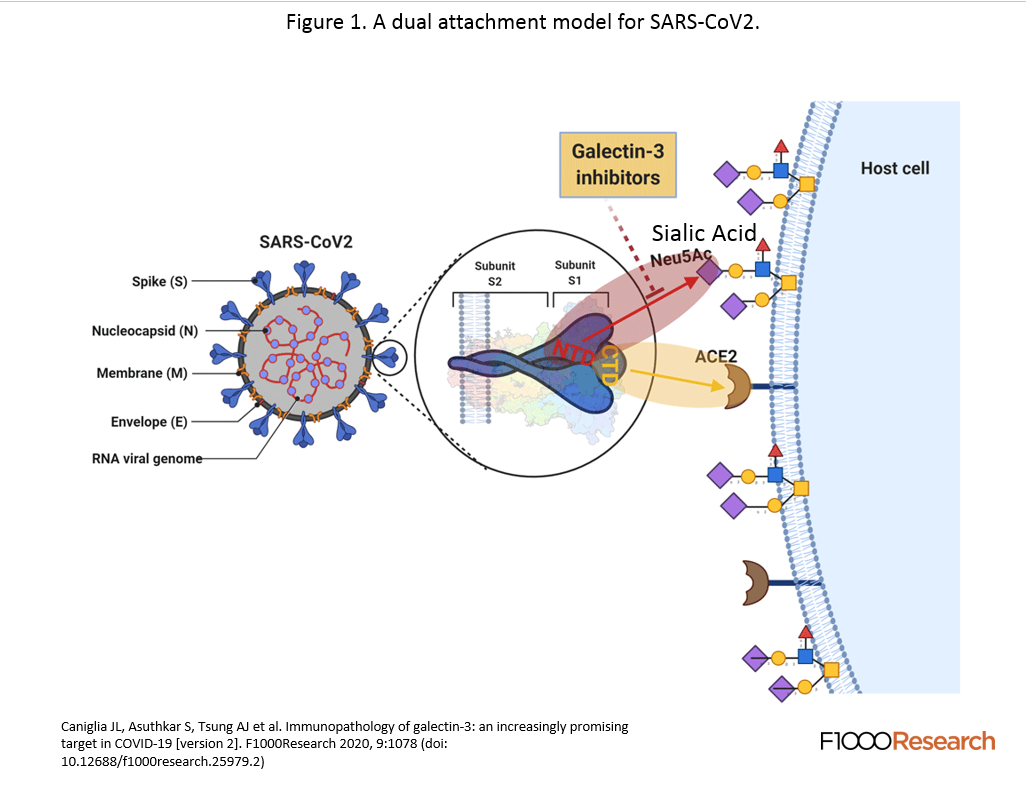

The first article published was “A potential role for Galectin-3 inhibitors in the treatment of COVID-19.” This article connected the dots to show that Galectin-3 had both immnomodulatory properties and interfered with the binding of the spike protein to the sialic acid. This graphic shows that there is a binding side on the side of the coronavirus spike and disrupts the attachment of the virus to the host cell. The study goes on to show that the inhibitor is immunomodulatory by action on the dendritic cells and suppressing the reduction of TNFα, and IL-6.

What is amazing about this story is that belapectin is named on the cartoon graphics. It’s not very hard to connect the dots about what they are theorizing. In the abstract it said

“We propose a dual mechanism by which Gal-3 inhibition may be beneficial in the treatment of COVID-19, both suppressing the host inflammatory response and impeding viral attachment to host cells”.

The second article titled “Understanding the role of galectin inhibitors as potential candidates for SARS-CoV-2 spike protein: in silico studies” demonstrated via computer simulation the molecular docking dynamics of how a galectin inhibitor could block the spike protein on COVID-19. The author mentions the early work of Bioxytran and how they theorized that a galectin inhibitor could bind to the spike protein. This inspired them to conduct many simulations with molecules including Galecto Biotechs lead candidate TD-139. Belapectin was not mentioned at all so the inhibitor may have not been tested. TD-139 made the top 5 candidates and was characterized as a “potential hit.” TD-139 is currently in clinical trials in combination with Nafamostat Mesilate which is an antiviral protease inhibitor. If Galectin Therapeutics recently collaborated they might have found out that they were a molecular hit as well. It should be interesting to see what comes out of this conference call.

The article concluded that

“The present study paves the way for in vitro and in vivo testing of galectin inhibitors against SARS-CoV-2. In addition, it warrants a swift examination of TD-139 for treating COVID-19.”

The final article titled “Immunopathology of galectin-3: an increasingly promising target in COVID-19” really brought all the ideas together and showed the strong immunomodulatory side of galectin inhibitors. The article was similar to the second in that it implicated sialic acid in the initial recognition of the viral spike protein that stabilized it for attachment to the ACE-2 receptor. The galectin inhibitor attaches to the NTD area of the spike protein and protrudes out to the point whereby the sialic acid cannot bind to the COVD-19 spike, stabilizing the ACE2 entry.

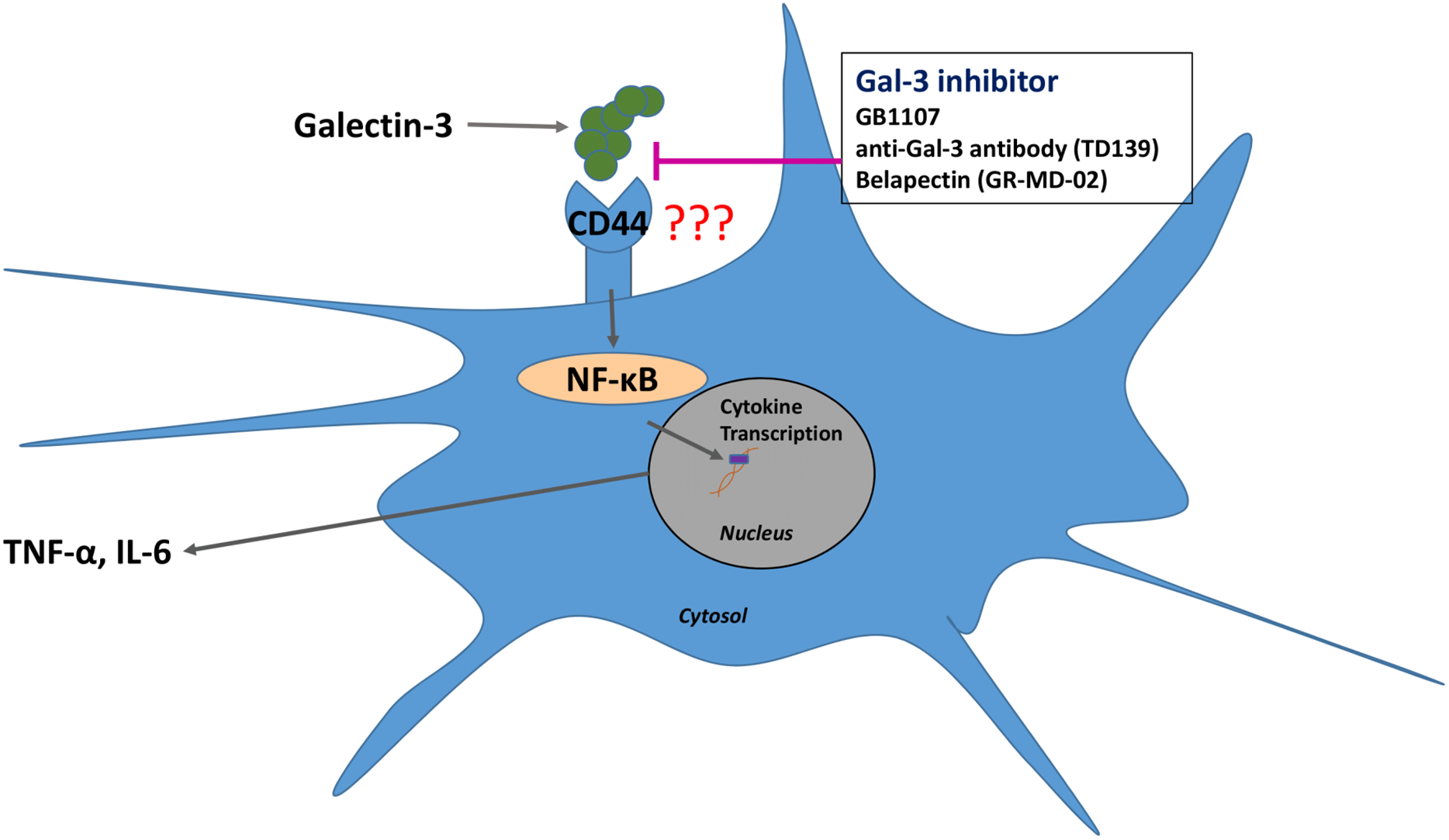

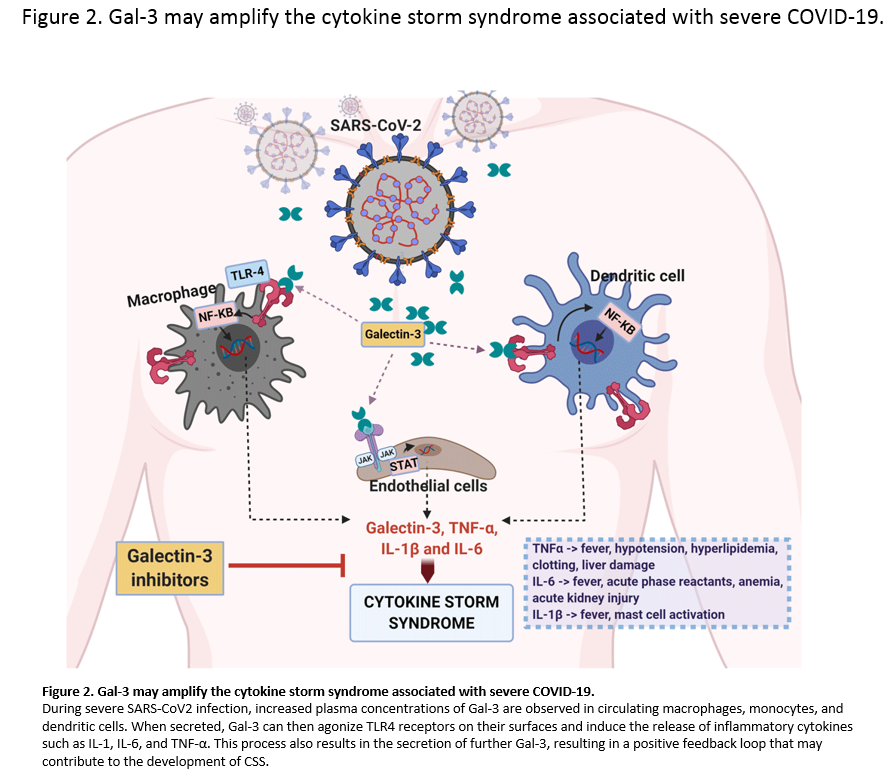

Single cell analysis of mild and severe COVID-19 patients showed elevated levels of Galectin-3 in macrophages, monocytes, and dendritic cells. In vitro studies showed that inhibiting Galectin-3 reduced the release of IL-1, IL-6, and TNFα. There was also a reduction in transforming growth factor beta (TGF-β) which is needed for pulmonary fibrosis.

There is an FDA approved test for Galectin-3 and it prognosticates heart failure. All three of these studies are in agreement that higher levels of Galectin-3 in patients results in poorer outcomes, but they dont explain why. What these articles do suggest is that Galectin-3 blood serum should be an excellent prognosticator of outcomes in COVID-19. Chronic diseases like diabetes have inflammatory cycles driven by galectin-3 which impairs the immune system so inhibiting them makes sense. Many may forget but Galectin Therapeutics has a patent for treating diabetic nephropathy and heart failure which are comorbidities of COVID-19. . .

The reason why COVID-19 patients end up with poor outcomes is due to the T-Cell anergy. Galectin-3 is upregulated in virally infected cells to assist with the budding of the virus. This is very much the same way that the stromal cells secrete Galectin-3 around a cancerous tumor and coat a layer of plaque on the T-Cells. There is evidence that suggests that high concentrations of galectin plaque affects CD-8 T-Cell function and leads to T-Cell anergy in viruses. An adaptive immune system without the right ratio of CD4/CD8 cells is compromised and unable to wipe out the virus.

In the graphic above, Galectin-3 is at the heart of the inflammatory cycle. These glycoproteins modulate the immune system by determining the level of cytokine secretions by the immune cells. They also assist in the trafficking of immune cells to other areas of the body. Inhibiting the galectins stops the migration of the different types of immune cells. Leaving less immune cells in the pocket of inflammation. A smaller group of immune cells will excrete fewer cytokines and eventually the inflammatory cycle will quiet down along with the cytokine storm. This will lead to homeostasis in the immune system.

Belapectin’s Mechanism of Action in COVID-19

Galectin-3 Inhibitors

- Blocks the spike protein

- Modulate the immune system

- Reanimate anergic T-Cells

- Reduce post infection pulmonary fibrosis

Expanding Indications – (Hepatic Impairment, ALD, PBC, Oral Formulation)

Galectin therapeutics is also conducting a phase 1 open label study of hepatic impairment. What is interesting about this clinical trial is that they are screening out for Alcohol Liver Disease (ALD), and primary biliary cholangitis (PBC). This could mean a possible expansion into two more disease indications. Intercept Pharmaceuticals (NASDAQ: ICPT) drug Ocalvia is currently used to treat PBC. There is a small research joint venture that was established in 2014 called Galectin Sciences LLC. The company owns 82.6% of the company and saw a contribution of $309,000 this year. Their mandate was to develop an oral version of a galectin-3 inhibitor. Competitor Galecto Biotech recently unveiled GB1211 which is their version of an oral galectin-3 inhibitor. The recent influx of capital could mean a breakthrough is in the works for Galectin Therapeutics. Oral administration would dramatically lower the costs of the clinical trials and make recruitment much easier. If this oral formulation is confirmed or other trials hinted at on the conference call the stock could rise as investors realize what a powerful platform technology this has become.

Cancer Wildcard

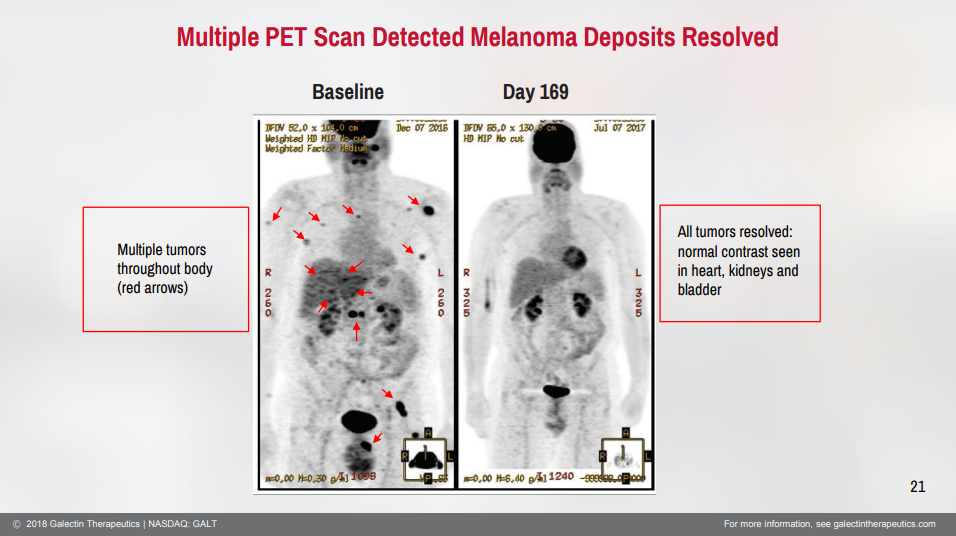

The phase 1 clinical trial in cancer has been complete for some time. One of the major findings is that there is an optimal dose of belepectin that should be given in combination with Keytruda. Investors have been waiting years to see if there is a follow on study. Nothing has posted on clinicaltrials.gov but the mere mention of plans to conduct a cancer study could drive investors animal spirits. As a refresher in one cohort of the melanoma clinical trial there was a 100% objective response rate and a 33% complete response rate in refractory melanoma patients.

Financial Analysis

The market capitalization of the company is $208 million. The company has approximately $40 million in cash. It also has a $10 million unsecured and untapped credit line with Chairman Uhlien. There are currently 57 million shares issued and outstanding. There are also 12.5 million warrants with an exercise price of $4.22 so should the stock appreciate in the money the company could see a noticeable influx of capital from warrant exercises. The company has a quarterly burn rate close to $6.0 million but it is expected to accelerate rapidly once patients are onboarded in their clinical trials.

Investment Summary

We believe Galectin Therapeutics is going to enter the coronavirus race in an epic fashion. It’s quite likely that GALT will cover this topic in the investor call today. The run up yesterday represents only a small fraction of the COVID-19 market and therefore very little is priced into the current equity at a $200 million market capitalization. If management does not mention COVID-19 on the call despite the preponderance of evidence that it is a viable target, then investors will have to look very critically upon management’s ability to develop a galectin inhibitor platform technology. It’s possible that Galectin Therapeutics might have been too slow to enter the COVID race because most of these journal articles are less than 2 months old. The fall back plan for the company might be a resumption of the cancer trials which have been on pause waiting for a finalization of the NASH Phase 3 clinical trial design.

As a minimum the CEO should make the case that the stock is extremely undervalued on a number of metrics. He should emphasize his commitment to the project and the chairman’s commitment to put in whatever it takes with respect to capital to get through the approval process. They are the leader in late stage NASH however CytoDyn is giving them a run for their money with their recently announced clinical trial. The NASH Market is projected to be $37.3 billion in seven years with room for multiple treatment options. They also have a cancer franchise aching to be developed and each phase 2 indication could be worth $500 million. Overall the package is pretty exciting and it looks like Galectin Therapeutics is getting an extreme makeover with respect to new leadership, clinical trial funding, and an expansion of their platform into either COVID-19 or cancer.

AboutEmergingGrowth.com

EmergingGrowth.comis a leading independent small cap media portal with an extensive history of providing unparalleled content for the Emerging Growth markets and companies. Through its evolution,EmergingGrowth.comfound a niche in identifying companies that can be overlooked by the markets due to, among other reasons, trading price or market capitalization. We look for strong management, innovation, strategy, execution, and the overall potential for long- term growth. Aside from being a trusted resource for the Emerging Growth info-seekers, we are well known for discovering undervalued companies and bringing them to the attention of the investment community. Through our parent Company, we also have the ability to facilitate road shows to present your products and services to the most influential investment banks in the space.

All information contained herein as well as on theEmergingGrowth.com website is obtained from sources believed to be reliable but not guaranteed to be accurate or all-inclusive. The statements in this article are not that of, nor have they been verified by, or are the opinion of, EmergingGrowth.com.All material is for informational purposes only, and should not be construed as an offer or solicitation to buy or sell securities. The information includes certain forward-looking statements, which may be affected by unforeseen circumstances and/or certain risks.Please consult an investment professional before investing in anything viewed within.

Contact Information:

Media Contact

email: info@emerginggrowth.com

+1 (305) 330-1985

Tags:

, Google News, IPS, Extended Distribution, iCN Internal Distribution, English

Contact Information:

Media Contact

email: info@emerginggrowth.com

+1 (305) 330-1985