To be financially stable means to manage your finances properly. Elizabeth Warren was a personal finance expert, who reckoned that the economy should be a priority in the USA to improve. She struggled to help the average American citizen to fix his/her financial situation.

The 50/20/30 budgeting rule was mentioned in her New York Times Bestseller: “All Your Worth: The Ultimate Lifetime Money Plan”. In short, the idea of the rule is that you spend 50% of your income on needs, 30% on wants, and 20% you save.

Why Do We Need to Follow the 50/20/30 Budgeting Rule Today?

Today’s reality is changing rapidly due to the latest events connected with the war in Ukraine. Many people all over the world faced financial difficulties. The reason is that they didn’t think ahead to stay tuned in front of any hardships managing their budget.

The golden rule is that we should remember: even when forecasts say that there won’t be any significant inflation raise, it’s better to be ready for uncertain times than to look for 500 loan bad credit for a grocery one day.

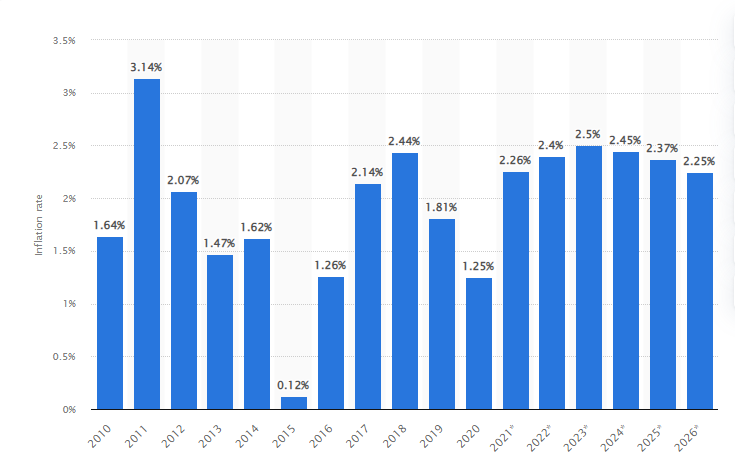

Though the experts predicted quite a moderate growth of the inflation rate in the US from 2010 to 2026, we see that it is still hard sometimes to calculate everything accurately and predict all global circumstances.

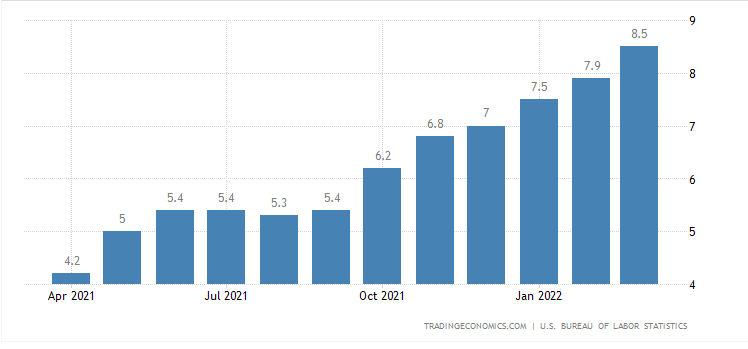

According to the research of Trading Economics, inflation in the USA gained its historic high rate. In March 2022 inflation reached 8,5% and broke the record of December 1981 when the annual inflation rate was 7.9%. Not only the prices for gasoline and fuel oil have grown but also for food.

It becomes clear that people, who have never been interested in financial planning are facing hard times today. Fortunately, it is never late to start managing your money and implement the 50/20/30 rule into your financial strategy.

What Are Your Needs?

The rule says that the most optimal variant is to spend 50% of your income on needs. These are things that you urgently need to survive and live your life comfortably. That’s why you are obliged to spend half of your monthly budget on it, that may seem upsetting, but it’s worth it!

Needs usually include: paying bills for electricity and gas, rent, insurance, medicine, and of course, a basic food package is on the list of your needs.

You are to make sure that 50% of your income covers your needs. If you can’t do it, you are to think over the way you spend your money. Maybe, you spend them unwisely or waste them pointlessly on things you actually don’t need. Try to cut the number of impulsive purchases.

Remember, that your needs are the most important ones to pay off to live a comfortable life. Nobody wants to have the electricity supply stopped, right? That’s why paying taxes is not only your state responsibility but also your self-responsibility to live a good life.

What Are Your Wants?

Wants are things you spend your money on, but actually, you can live without them. Going to restaurants, cafes, movie theatres, and sports clubs are the most popular people’s wants. They may also include a subscription to some services, unnecessary purchases, etc.

Though, it is okay if sometimes you want to buy a new gadget or new clothes to make you feel confident and satisfied. But if you have difficulties while paying for your needs, it is a sign you should limit your wants.

You shouldn’t come up with some crazy idea to cut your spending on wants. Everything you need to understand is that even cooking at home saves your money. You can use the Internet to find some sports programs and work out at home instead of paying much for a gym. Following such a principle, you may stop yourself from spending a lot of money, that can be saved for a bigger goal.

What Good Can 20% of Your Income Saving Do to You?

First, you will be always ready for any rapid changes in your life. We cannot always be sure about what will happen to us in two months and we should have a financial cushion.

It will prevent you from taking loans. Many Americans use their credit cards unreasonably and it often leads them to be up to their eyes in debt. Paying a debt off is a long process, which may take months or even years to get rid of.

In order not to get into such trouble, saving 20% of monthly income will be enough. It may not seem to be a big sum, but, if you will be sticking to the rule for a year, you will feel much more financially confident and stable.

If it is a problem for you to start saving money to buy a car, a house of your dream, or to make any essential purchase you were yearning for, then saving money will make your dream come true. Though you will still have to save money for a long time, it is better than doing nothing at all. Even little steps matter and help you to gain the aim.

Saving for retirement is one more reason to start doing it right now. Getting a good retirement payment is not so easy, that’s why the earlier you start saving money, the more money you will have in the future.

Does the 50/20/30 Budgeting Rule Always Work?

The rule is supposed to work almost in every case, but there is an exception. If you notice, that you spend more than 50% of your monthly wage on your needs, it means that your income may not be very high.

To make your situation comfortable for you without prejudice to your life, you are to calculate your own formula based on the 50/20/30 rule. Get to know how much money you spend on bills and adapt your income in a way to save even the smallest opportunity to spend some of your money on needs.